EB-5 Investor

The EB-5 Investor Visa Program, administered by USCIS, offers foreign investors and their families the opportunity to obtain lawful permanent residence in the United States, commonly known as a Green Card. To qualify for the EB-5 visa, investors must fulfill the following requirements:

- Investment in a Commercial Enterprise: Make a substantial investment in a commercial enterprise in the U.S. This can include establishing a new business or investing in an existing one.

- Creation or Preservation of Jobs: Plan to create or preserve at least 10 permanent full-time jobs for qualified U.S. workers through investment.

Program Overview

- Congressional Creation: Established in 1990, the EB-5 Program aims to stimulate the U.S. economy by attracting foreign investment and generating employment opportunities for U.S. workers.

- Regional Center Program: In 1992, Congress introduced the Immigrant Investor Program, also known as the Regional Center Program. This program allocates EB-5 visas for investments made through regional centers approved by USCIS, focusing on projects that promote economic growth.

- EB-5 Reform and Integrity Act: Signed into law on March 15, 2022, this legislation introduced new requirements for the EB-5 immigrant visa category and extended the authorization of the Regional Center Program until Sept. 30, 2027

Basic Requirements

- Investment Criteria: Investors must invest in a new commercial enterprise established after Nov. 29, 1990, or meet specific criteria for businesses established on or before that date. The enterprise must engage in lawful business activities and be structured as a for-profit entity.

- Investment Options: Eligible commercial enterprises include sole proprietorships, partnerships, corporations, and other for-profit entities. Noncommercial activities, such as personal residences, are not eligible for EB-5 investment.

- Form I-526 Petition: Investors must file Form I-526, Immigrant Petition by Standalone Investor, or Form I-526E, Immigrant Petition by Regional Center Investor, to initiate the EB-5 application process.

Capital Investment Requirements

Capital means cash and all real, personal, or mixed tangible assets owned and controlled by the immigrant investor. All capital will be valued at fair-market value in U.S. dollars.

The definition of capital does not include:

- Assets acquired, directly or indirectly, by unlawful means (such as criminal activities).

- Capital invested in exchange for a note, bond, convertible debt, obligation, or any other debt arrangement between the immigrant investor and the new commercial enterprise.

- Capital invested with a guaranteed rate of return on the amount invested; or

- Capital invested that is subject to any agreement between the immigrant investor and the new commercial enterprise that provides the immigrant investor with a contractual right to repayment, except that the new commercial enterprise may have a buy back option that may be exercised solely at the discretion of the new commercial enterprise.

Note: Immigrant investors must establish that they are the legal owner of the capital invested. Capital can include their promise to pay (a promissory note) in certain circumstances.

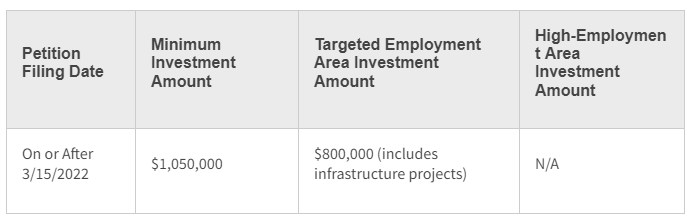

The minimum investment amounts by filing date and investment location are:

A targeted employment area can be, at the time of investment, either:

- A rural area; or

- An area that has experienced high unemployment (defined as at least 150% of the national average unemployment rate).

A rural area is any area other than an area within a metropolitan statistical area (MSA) (as designated by the Office of Management and Budget) or within the outer boundary of any city or town having a population of 20,000 or more according to the most recent decennial census of the United States.

A high-unemployment area consists of the census tract or contiguous census tracts in which the new commercial enterprise is principally doing business, which may include any or all directly adjacent census tracts, if the weighted average unemployment for the specified area based on the labor force employment measure for each tract is 150% of the national unemployment average.

Regional center investors may choose to invest in a new commercial enterprise engaged in an infrastructure project.

An infrastructure project is a capital investment project in a filed or approved business plan, which is administered by a governmental entity (such as a Federal, State, or local agency or authority) that is the job-creating entity contracting with a regional center or new commercial enterprise to receive capital investment under the regional center program from alien investors or the new commercial enterprise as financing for maintaining, improving, or constructing a public works project of these set-aside visas that go unused are held in the same set-aside category for one more fiscal year.

Application Process

- Form Submission: File Form I-526 or Form I-526E with USCIS, depending on the investment type.

- Visa Availability Check: Ensure immigrant visa availability by consulting the Visa Bulletin and Adjustment of Status Filing Charts on the USCIS website.

- Form I-485 or DS-260: If an immigrant visa is immediately available, file Form I-485, Application to Register Permanent Residence or Adjust Status, or DS-260, Application for Immigrant Visa and Alien Registration, with USCIS or the U.S. Department of State, respectively.

- Conditional Permanent Residence: Upon approval of Form I-526 or Form I-526E, investors may be granted conditional permanent residence for a two-year period.

- Form I-829 Petition: File Form I-829, Petition by Investor to Remove Conditions on Permanent Resident Status, within 90 days before the second anniversary of obtaining conditional permanent residence to remove conditions from permanent resident status.

Croce & Associates Assistance

For professional guidance and support throughout the EB-5 application process, consider consulting Croce & Associates. Our experienced immigration attorneys can provide tailored assistance to ensure compliance with EB-5 requirements and facilitate a smooth transition to permanent residency in the United States. Contact us at info@crocelegal.com or call 786-200-3088 to schedule a paid consultation.